5 Trendsetters: The 2023 Outlook for Telecom Industry

The beginning of the 5G era being a catalyst, 2022 presented many challenges and opportunities to the telecommunications industry as dynamic regulations, technological advancements, and a competitive environment. The growing importance of 5G, IoT, decentralized broadband infrastructure, big data, and cybersecurity is transforming the face of telecom services, e.g. hyper-personalized marketing campaigns through AI-led enterprise messaging solutions.

Mobile network operators are augmenting their network capacity with additional wireless and fiber deployment to meet the constant demand for high-speed, secure, and innovative enterprise applications like unified communications, A2P messaging solutions, etc. The global 5G infrastructure market value is forecasted to reach $131.4 billion by 2030 from $1.18 million in 2021.

Besides, trends like Low-power Wide Area Networks, blockchain asset inventory, edge computing, and MNOs carving out their passive infrastructure into dedicated tower companies may influence telecom progress in the upcoming years. Let’s see the five biggest trendsetters that will define the future of the telecommunications industry.

Overview of the Current Telecom Sector Scenario

The major challenge the telecom industry faces is the digital divide between the individuals with access to broadband/internet and those without it. It can be considered a serious issue because internet access isn’t a luxury but a necessity for schools, government offices, financial services, and businesses.

While MVNOs are addressing this issue with their narrow focus on specific market segments, telcos are also moving towards uberization. Like Uber and Airbnb, telecom players are adopting a new business model to capture the dynamic nature of the market.

Despite the challenges, the telecom future seems brighter as telecom leaders are doubling down on infrastructure enhancements, strategic differentiation, brand collaboration, and operational efficiency. Besides B2C services, telcos reinvent B2B connectivity by enabling connectivity on the go, network automation, Network-as-a-Platform, and connected cloud industry orchestration.

Key Telecom Industry Trends: Outlook for 2023

LoRaWAN and NB-IoT

LoRaWAN is a Wide Area Network supported by an open, non-profit association—LoRa Alliance, recognized by Telecommunications Standardization Sector. It is optimized for long-range and ultra-low-power applications in the ISM (Industrial, Scientific, and Medical) sub-GHz spectrum. Since LoRaWAN networks operate on this unlicensed spectrum, network operators and device manufacturers can access it free.

Narrowband Internet of Things is another Low Power Wide Area Network (LPWAN) technology that enables new IoT devices and services. It improves system capacity, spectrum efficiency, and power consumption of user devices, especially for extended, deep, and rural indoor coverage.

These trends simplify massive IoT deployments by allowing mechanical design innovation and robust internet security. For example, LPWAN-powered IoT sensors measure air quality in enclosed spaces.

Edge Computing to Take Center Stage

The multi-access edge computing and private cellular networks market is still in the emergent phase. However, organizations are lured by the potential benefits of their advanced use cases enabled by the convergence of greater spectrum availability, distributed edge computing architecture, 5G wireless technology, and artificial intelligence.

Edge cloud brings data collection, processing, storage, and analytics capabilities closer to the network equipment, such as Industrial IoT (IIoT) devices. It helps communications service providers (CSPs) and large enterprises to orchestrate resources over geographically distributed data centers. Besides, edge computing tools, such as Network as Code, AI, and open API, allow context-aware automation.

More Competitive Broadband Market

While many customers prefer Wi-Fi enabled by fiber or cable to access the internet, millennials and younger generations are twice as likely to choose mobile data plans over home Wi-Fi. This choice can be attributed to unlimited data plans and the average download speed hitting 100 Mbps.

However, the 5G fixed wireless access (FWA) is expected to surpass the performance of wired broadband connections. It will lead to a rise in customers turning to wireless connections. At the same time, 5G FWA rollouts, fiber footprint expansion, and the ability of telcos to compete in the home broadband market will speed up industry competition and pricing pressure for broadband service providers.

Blockchain in Supply Chain Management

Blockchain has become a standard solution for the problems related to trust, transparency, and data synchronization across ecosystems, enterprises, and economies. Blockchain can tackle industry-wide issues like roaming settlements and mobile number portability in telecommunications.

Telecom supply chains are complex, comprising multiple parties and components, including physical and virtual products. Blockchain asset inventory and transaction management models can efficiently manage emerging telecom value-added services, dynamic pricing structures, and enhanced security.

5G and the Emphasis on Cybersecurity

5G network will support many devices with varying service and performance requirements. It will cause an explosive amount of data running on 5G networks with greater speed, diversity, and sensitivity. Besides, the rising trend in software-based and decentralized networks will increase surface attack area and points of entry, much like grey route traffic in enterprise messaging solutions.

Vendors, alliances, ecosystem partnerships, third parties, and new dependencies will intensify the risk of data mismanagement. Thus, 5G adoption will require skilled cybersecurity professionals to operationalize it successfully. The reassessment of security in 5G adoption may involve a switch from reactive security mechanisms to proactive ones with governance organizations in place.

Fine-tune your Strategies to be at the Forefront of Changing Telecom Landscape

Telcos must take the initiative to design and offer the best solutions for the ever-changing demands. 5G and IoT deployments will define the telecom industry’s progress in the coming years, but will not be limited to them. New telecom opportunities bring concerns that will need attention from innovative solutions like ultra-low power solutions, blockchain, and edge computing. Besides, with industry 4.0 unfolding in full swing, telecom players are expected to lead this revolution with next-gen connectivity.

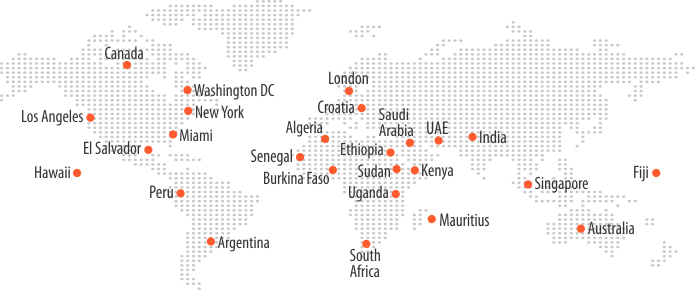

Bankai Group is an emerging leader in transforming the telecom market through technological innovations, offering easy voice communication, A2P messaging solutions, and more.

Related Posts

The Digital Shift in the Telecom Industry: Challenges and Trends

The Ultimate Stand Against Telecom Frauds in 2022 and Beyond