A2P Value Erosion: Addressing the Threats of Fraud and Pricing Dynamics

A2P messaging remains a major revenue driver for telecom operators, with market projections topping $84 billion by 2029. Yet behind this healthy growth lies a pair of critical threats: sophisticated fraud and pricing pressure that erode long-term profitability.

Fraud and pricing pressure aren’t new to A2P messaging. What’s changed is how these two problems work together to make things worse. Fraudsters use AI to create fake traffic that looks exactly like real business messages. At the same time, enterprise customers can see pricing from all providers in real-time and use that information to negotiate lower rates everywhere. These problems used to be separate – they feed off each other and hurt A2P profitability. Together, these dynamics create a system that demands a coordinated, strategic response from operators.

Traditional fraud was predictable and easier to stop – that’s why 50% of telecom operators reported reduced voice fraud for the first time since 2018. But AI-powered fraud is different. It learns from every attempt that gets blocked, changes its methods, and finds new ways to attack faster than security teams can keep up. The old security tools still work against old attacks, but they can’t handle smart operations that act like real businesses.

Let us explore how you can respond to these evolving realities:

Breaking Down the Economics of Value Destruction

When operators cut prices to win deals, they are forced to reduce security budgets to maintain margins. Reduced security creates vulnerabilities that fraudsters exploit. The resulting revenue losses force even deeper price cuts to maintain volume. This pattern risks creating a cycle where profitability becomes increasingly difficult.

Market segmentation makes this worse. Premium enterprise customers still pay for quality and security. Mid-market customers only care about price. Trying to serve both with the same infrastructure and pricing model is a sure recipe for margin erosion.

The result satisfies neither segment while destroying margins across the board.

Strategies to Counter Fraud and Pricing Pressure

Breaking this cycle requires addressing both elements simultaneously rather than treating them as separate problems. One way operators can deal with this problem is by implementing segmented service tiers that explicitly link security investments to pricing levels. Premium tiers would include advanced fraud prevention, guaranteed delivery, and dedicated support to justify higher rates. Budget tiers could operate with automated systems and basic security, allowing lower pricing while maintaining margins. This segmentation would align customer expectations with operational reality, recognizing that different traffic types require different service levels.

Dynamic cost modeling should incorporate fraud losses directly into pricing calculations. Traditional models that only consider network costs create incomplete pictures of true service costs. Including expected fraud losses based on security investment levels would reveal which customer segments actually generate profits versus those that cost money to serve. To counteract the cycle of value destruction, operators must tackle fraud and pricing in tandem rather than in isolation.

While segmentation is a must, let us explore achievable measures to counter the fraud-pricing duet:

Turning AI and Consortium-based Intelligence Sharing Against Fraud

Today’s fraud operations often employ technical specialists who build systems that analyze legitimate traffic patterns. These systems identify which message characteristics typically pass detection filters. As operators update detection rules, fraud systems can adapt quickly by testing new approaches.

Ensemble models combining multiple detection approaches provide robust defense because different algorithms catch different fraud types. Pattern recognition identifies known attacks while anomaly detection catches unusual behaviors. When these approaches work together, they compensate for individual weaknesses while resisting attacks that target specific algorithms.

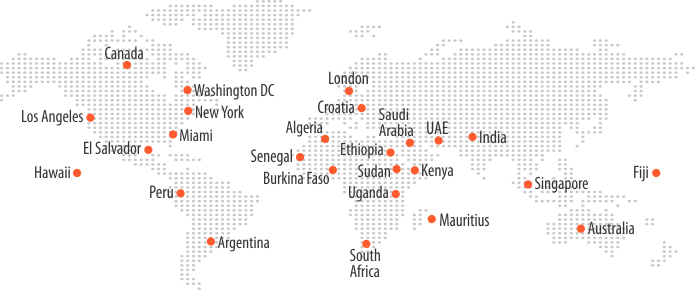

Consortium-based intelligence sharing multiplies detection effectiveness without revealing competitive information. Sharing fraud signatures without revealing customer data strengthens every member’s defenses. One operator’s detection of a new pattern immediately protects the entire network. Regional consortiums like the GSMA Fraud & Security Group already demonstrate this model works—global expansion would transform fraud detection from isolated silos into an industry-wide defense grid.

Honey pot services can be used to attract fraud attempts safely while gathering intelligence on emerging techniques. These deliberately vulnerable endpoints appear valuable while carrying no real traffic. Fraudsters reveal their methods when attacking these services, providing early warning about new vectors before they impact revenue. This intelligence feeds continuous learning systems that adapt automatically.

Reclaiming Pricing Power Through Value-based Pricing

Large businesses now monitor A2P messaging rates across all providers continuously, using the lowest price as leverage against all competitors. OTT platforms make this worse by treating messaging as customer acquisition cost rather than revenue source. Traditional operators cannot match free when their business model depends entirely on message fees.

Value-based pricing ties rates directly to the business outcomes that messages deliver, not just the number of messages sent.

Authentication messages preventing fraud justify rates far exceeding promotional messages because they create different value despite using identical infrastructure. This model escapes commodity pricing by demonstrating measurable ROI.

Bundling messaging with complementary services creates unified solutions that solve business problems. Combining SMS with voice verification, email, and push notifications makes price comparisons difficult. Adding analytics and optimization services helps customers improve effectiveness while justifying premium pricing through demonstrated value.

Surge pricing during predictable peak periods captures value that fixed pricing models miss. Black Friday, tax deadlines, and holiday seasons create demand spikes where customers pay premiums for guaranteed capacity. Enterprise customers already budget for seasonal variations in other services, making them receptive to transparent surge pricing.

Closing Regulatory Arbitrage with Coordinated Restrictive Measures

Some fraudsters establish businesses in jurisdictions with limited A2P oversight, using these operations as cover. Grey routes persist partly because legitimate routing can be complex and costly for enterprises. When price differentials exist between markets, arbitrage opportunities emerge that some operators exploit.

Making legitimate routing more attractive requires removing barriers that push enterprises toward unauthorized alternatives. Volume discounts, simplified onboarding, and quality guarantees address why businesses reluctantly choose grey routes over complex legitimate options.

Industry certification programs, along with regional regulations like RCS implementation, help customers distinguish compliant operators from questionable providers.

Regular audits provide clear differentiation, allowing certified operators to charge premiums while creating pressure for non-certified providers to meet standards.

Reciprocal enforcement agreements between operators multiply the impact of individual blocking actions. Grey routing becomes unprofitable when blocked sources cannot simply shift to other networks. This coordinated approach makes compliance the path of least resistance.

Conclusion: Strategic Repositioning for Sustainable Monetization

A2P monetization remains highly profitable for operators who understand its true value. The market continues growing because enterprises need reliable communication channels for critical business processes. Fraud and pricing pressure threaten profitability, not demand.

Success requires choosing a market position and committing fully. Premium operators must invest in security, quality, and service to justify higher prices. Volume operators should optimize efficiency and automation to compete on price. Both strategies work when executed properly. Attempting both ensures mediocrity because operational requirements conflict.

Deep vertical expertise creates defensible positions through an understanding of specific requirements. Financial services value security above cost. Understanding vertical-specific requirements allows for targeted service development that competitors can’t easily replicate. Deep expertise in chosen verticals justifies premium pricing while creating barriers to entry.

The path forward is clear. Operators must decide whether to compete on price or value, then align their entire organization around that choice. Contact us to spot and map your hidden margin leaks and redesign your A2P SMS monetization strategy for sustainable, defensible growth.