NFC – The Communication Channel Outside Your Wallet

Myanmar is one of the last frontiers of the world. After having opened to free market

I was slightly taken aback. Yet, when I thought deeply, I realized, “why not?”. While I recommended a phased approach to go with basic services and access channels in the beginning, and then think of doing NFC way, I also understood that the service is not anymore a luxury circumscribed to selected few in cash rich early adopter nations, but is a global phenomenon and is going to be the next big in our part of the world as well.

NFC’s genetics

Near Field Communications traces its origin to year 2004 when Nokia, Philips and Sony converged to achieve what was considered as mission impossible till then, or was seen in those sci-fi movies where inner thoughts exchanged among humans through shake of hands with no vocal chords involved.

Yes, the concept was replicated by enabling information exchange between two handheld devices by a mere tap with each other. The basis for this information exchange is the short range high frequency wireless technology (10 cm range with frequency of 13.56 MhZ) that enables this phenomena christened as NFC.

NFC finds its utility in various use cases viz. access control to get entry in a secured area, to get detailed information from an NFC poster on wall… and many more.

Here are 2 fascinating examples

1. The biggest beneficiary of NFC has been the mobile financials space where we operate and which had given rise to the phenomena of eTailing. Here a window shopper can place an order by tapping mobile on a merchandise through the glass window while outside the store, and have money debited from his mobile wallet (the digital container where money is held).

The expression of interest to order turnaround in this case is a fraction of minute, as against the manual purchase wherein long service queues sometimes fade away the interest and cost the impending purchase. A brilliant instance of this will be Singtel’s NFC enabled mWallet service.

It is extremely popular and has taken mobile commerce to new heights. Retailers as Starbucks, Carrefour have partnered with Singtel to give a delightful customer experience and importantly for queue busting in their stores.

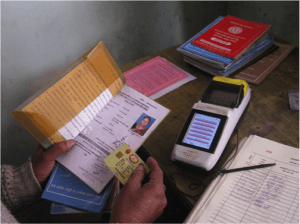

2. Acclaimed non-profit initiatives like UN’s World Food Program (WFP) also intend to ride on the NFC wave for enhanced operational efficiencies. A unique cash and voucher approach for food distribution to Below Poverty Line people is a case in point.

Such people will carry an NFC enabled card (akin to an ATM card) given by WFP and will use it to claim their food entitlements from WFP distribution centers. A tap of the card on the WFP agent terminal would authenticate the beneficiary and subsequently debit his digital wallet held on the card, to get food at subsidized rates.

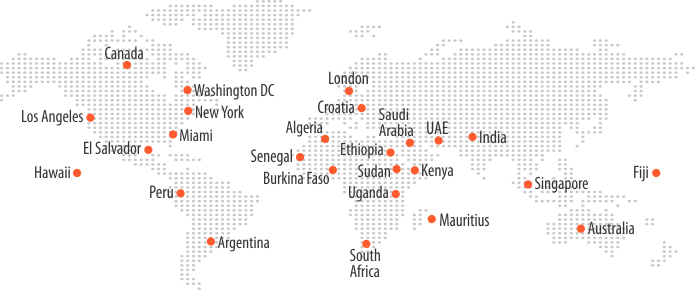

Owing to such multi-faceted use cases of NFC, catering to heterogeneous socio-economic strata, it has thus become imperative for an MFS platform to support NFC based access – to attain the cutting edge status and have a sustained usability in both emerging and emerged markets.

Gone are the days when less secure and typo error prone SMS used to be the solo access channel for accessing financial services on mobile. Now we have popular modes as mobile apps, portals or USSD that are interactive and don’t require much of free flow text based time consuming input. However, change is imminent and with the race among businesses to come up with the apt customer experience approach, NFC is the right fit. The popularity of NFC based touch and pay approach is already wide spread, as an access channel is far more secure through related Host card emulation (HCE) techniques, is available in almost every mobile phone (an android phone costing 40 USD is also equipped with NFC). We are going to see the NFC regime in MFS going forward, it may capsize the access channels of today.

Panamax’s MobiFin is an intelligent, carrier-grade MFS platform that enables an access channel agnostic approach i.e. has inbuilt support ranging from primitive SMS to the heavyweight NFC. More details on MobiFin can be accessed at http://www.panamaxil.com/mobile-financial-solutions/. To get further insights on NFC, it would be worth a visit to http://www.nearfieldcommunication.org/.